stock option tax calculator uk

Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Secfi Can You Avoid Amt On Iso Stock Options

Lets get started today.

. The 42 best Stock Option Tax Calculator Uk. This gives you the option to buy up to 30000 worth of shares at a fixed price. Taxes for Non-Qualified Stock Options.

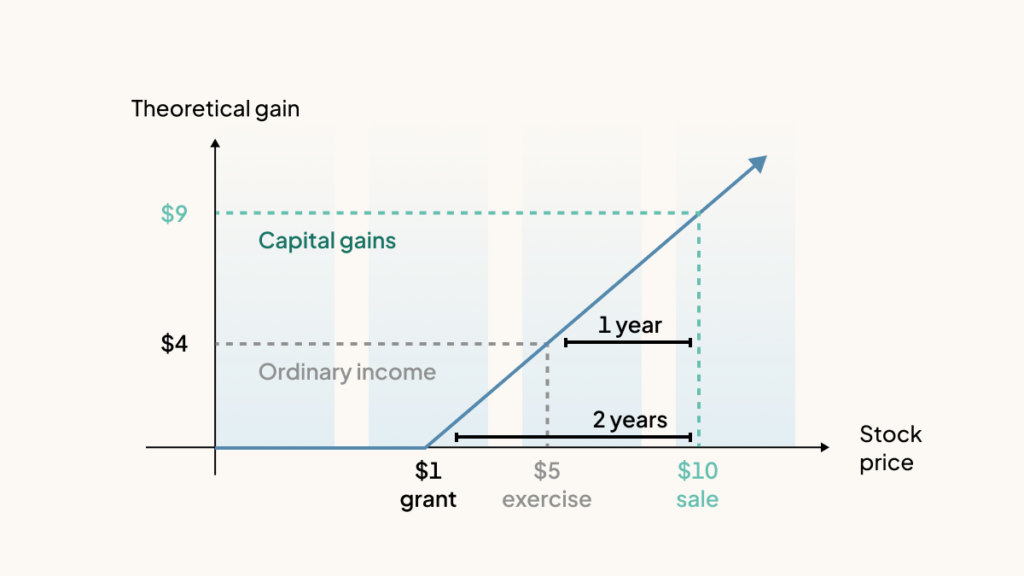

The 42 best Stock Option Tax Calculator Uk images and discussions of May 2022. The rate of CGT on the disposal of the shares in the UK can be as low as 10 per cent. The grant and vest of the shares follow the description above and neither of these are taxable.

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. On this page is a non-qualified stock option or NSO calculator. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios.

Nonqualified Stock Options NSOs are common at both start-ups and well established companies. Stock option tax calculator uk Friday May 6 2022 Edit. Non-Qualifying Stock Option NSO This is the most common form of option.

How much are your stock options worth. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. This permalink creates a unique url for this online calculator with your saved information.

The rate of CGT on the disposal of the shares in the UK can be as low as 10 per cent. Lets say you got a grant price of 20 per share but when you exercise your. Section 1256 options are always taxed as follows.

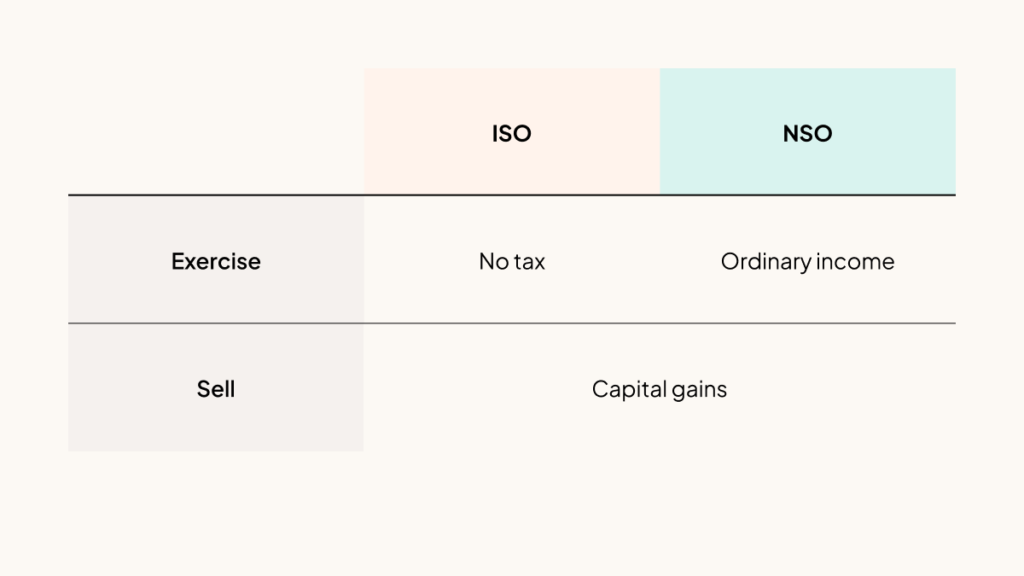

You will not pay Income Tax or National Insurance contributions on the difference. Per IRS Topic 409 if you trade in. There are two types of taxes you need to keep in mind when exercising options.

Restricted Stock UK Summary. The issue of stock options under an advantageous plan should also mitigate any social security payable by. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need.

If the scheme is unapproved then any money you. NSO Tax Occasion 1 - At Exercise. The Stock Option Plan specifies the total number of shares in the option pool.

We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Exercising your non-qualified stock options triggers a tax. Ordinary income tax and capital gains tax.

Company Share Option Plan. I went though a similar process last year with my stock options were forcibly exercised when we were acquired. Nonqualified Stock Option NSO Tax Calculator.

Lets get started today. By admin Jul 28 2022 employee stock options tax how to minimize taxes on stock. 60 of the gain or loss is taxed at the long-term capital tax rates.

When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. The 49 best Stock Option Tax Calculator images and discussions of March 2022. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Ad Were all about helping you get more from your money. Only for employees tax favored treatment which is as low as 10 percent if the option is held for two. In our continuing example your theoretical gain is.

Ad Were all about helping you get more from your money. Stock Options Trading can be a very attractive way for an investor to make some money. Non-tax favored Options UK ISO US.

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Click to follow the link and save it to your Favorites so. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Small Business Accountancy Services In The Uk Are Highly Affordable Mutuals Funds Equity Fund

Negative Equity What Is It How Can You Calculate It Equity Home Buying Process Negativity

How To Calculate Your Income Tax Step By Step Guide For Income Tax Calculation Youtube

How Stock Options Are Taxed Carta

Capital Gains Tax What Is It When Do You Pay It

Rsu Taxes Explained 4 Tax Strategies For 2022

Calculator For Determining The Adjusted Cost Base Of Etfs Mutual Funds Reits In Canada There Are Free And Pre Capital Gain Financial Fitness Investing Money

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Taxes On Stocks How Do They Work Forbes Advisor

Cost Of Debt Kd Formula And Calculator Excel Template

How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

How Stock Options Are Taxed Carta

Etf Vs Index Funds Top 8 Differences You Must Know Stock Exchange Index Fund

Benefits Of Buying Private Health Insurance From Insurance Agency In Canada Group Life Insurance Life Insurance Companies Life Insurance Policy

Esops Rising Post Budget As Startups Do The Math Budgeting Start Up Wealth Creation

We Have A Broad Range Of Skills And We Offer A Variety Of Services That Go Beyond What Is Listed Here If You Want More Inf Accounting Tax Return Tax Services

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)